Daily Trading Routine

- Hunter

- Jul 17, 2025

- 3 min read

Every day the stocks I trade are different, but the structure stays the same. Here's what a typical day looks like for me in the market.

Pre-Market: Laying the Groundwork

My day kicks off early. First thing I do is load up my scanner (Trade-Ideas) and start digging through the stocks that are gapping up big. I’m looking for setups that fit my criteria — high relative volume, up on some nonsense catalysts, potential for dilution, and clean daily charts. I also check for any tickers that were strong yesterday and are holding up into today for potential Day 2 mean reversion moves.

After that, I run through a few large-cap scans. Even though I mainly focus on small caps, it’s helpful to know what’s going on with earnings or if there’s any unusual volume in the big names. Sometimes a SPY move or a large-cap sympathy play can shift the tone of the whole day.

Research & Game Plan

Once I’ve got a shortlist of candidates, I start diving deeper. I open Evernote and write up my due diligence on each name: What do they do? Why is it moving? What are the fundamentals? What does the daily chart look like?

I use AskEdgar for the fundamental snapshot, and TradingView charts to mark out key levels — prior high volume resistance, volume shelves, gap fill zones, etc. Then I run my ideas by my trading pod. A quick group huddle to double-check blind spots and refine the plan. After that, I update my watchlist in my DAS trading platform to highlight only the top-tier setups that I might actually trade.

Mindset Check-In

Before the bell, I do a short mindset prep — something to ground me and get me present. The goal is to get calm, centered, and clear. Review my playbook, remind myself of my system, and mentally rehearse how I want to show up. No random trades. No chasing. Just clean execution.

Market Open: Game Time

Once the bell rings, it’s go time. I use DAS to execute my trades. The first hour is usually the busiest. This is when 90% of my execution occurs. I stay patient, wait for my entries, and manage my risk per my system.

After the initial flurry, things typically slow down a bit. I’ll keep trading throughout the day — sometimes adding to winners, cutting laggards, or re-adjusting stop levels if the structure changes. But the heavy lifting usually happens early.

Post-Market: Debrief & Documentation

When the market closes, I take screenshots of all my executions and drop them into our pod group chat with a quick blurb on the thesis and how I traded it.

I also keep a detailed calendar in Evernote to track every ticker I touched — labeling them by type (D1 gapper, D2 gap up, multi-day runner, etc.). This helps me see what setups are working and which ones need refining. Whenever I need to backtest a new idea I open my calendar and start going through the tickers one by one.

Journaling & Analytics

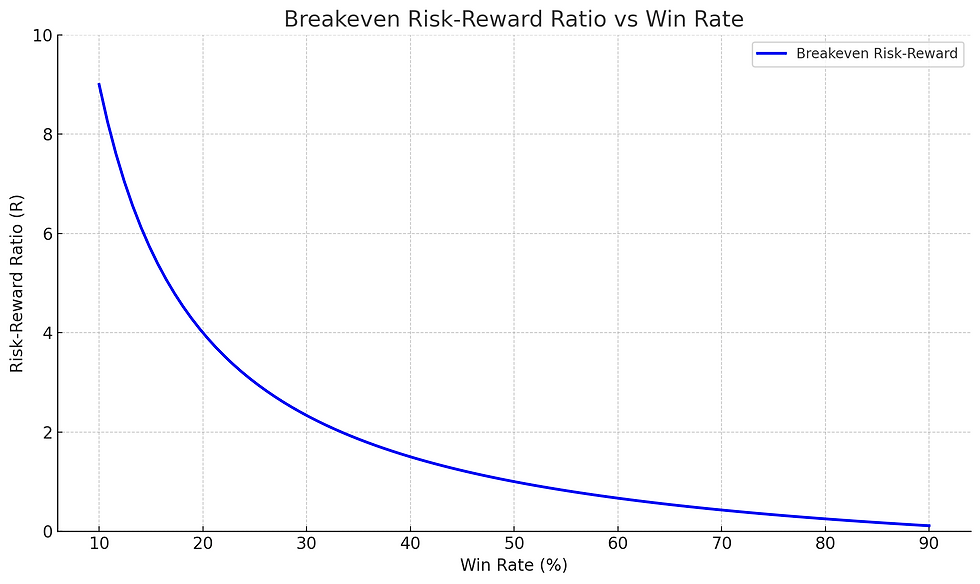

Next, I copy/paste my PnL and execution data into my custom Google Sheets journal. It tracks all the metrics that matter to me — win rate by setup, time of day, R-multiple, slippage, etc.

I also import everything into TraderVue as a backup and for more detailed performance analysis. They have an auto import feature which makes it really easy. I’m a big believer that what gets measured gets improved — and journaling is a core part of that.

Evening Reset & Review

After all that, I unplug from the screens for a while. Spend time with the kids, make dinner, just step away and let the brain breathe.

Later in the evening, I come back for review. I go bar-by-bar through each ticker I traded and compare my execution to my system. Did I follow the plan? Did I break rules? If I did, why?

I also look at tickers I didn’t trade but still fit my criteria. I replay them mentally — where I would’ve entered, where I would’ve exited, and how the trade would’ve played out. It’s one of the best ways I’ve found to sharpen my edge without risking capital.

Reset. Repeat.

Then it’s lights out. Wake up. Do it all over again.

This routine keeps me grounded, consistent, and constantly improving. There’s always more to learn, but having a structured daily process is what keeps me in the game.

Comments