Why Most Traders Lose (Even When They Win)

- Hunter

- Jul 28, 2025

- 3 min read

Let’s talk about a concept that flips most new traders on their heads: you can win more than half your trades and still lose money—or win less than half and still be wildly profitable.

It all comes down to this:

It’s not your win rate that matters—it's the relationship between your win rate and your average R-multiple.

What’s an R-multiple?

R stands for Risk. It’s the dollar amount you’re willing to lose on a trade—your stop.

Your R-multiple is how much you make or lose relative to that fixed risk.

Risk $100 and make $100? That’s a +1R win

Risk $100 and make $300? +3R win

Risk $100 and lose it all? –1R loss

The mistake most traders make is focusing only on their P&L in dollars, without tracking how much they’re risking and what their returns look like relative to that risk. That’s like trying to run a business without knowing your profit margin. There are a few ways to determine your R but the easiest way I found is to use a percentage of your account, which I will discuss more below.

Why Win Rate Alone is a Trap

New traders chase high win rates. They’ll go 8 for 10 and feel untouchable. But if those 8 wins are small and the 2 losses are big, they’re bleeding slowly without even realizing it.

Example A:

8 wins × +0.5R = +4R

2 losses × –2R = –4R

Net = 0R

That’s breakeven at best and doesn't even factor in slippage, commission, and ECN fee's.

Example B:

3 wins × +3R = +9R

7 losses × –1R = –7R

Net = +2R

Lower win rate, higher profitability.

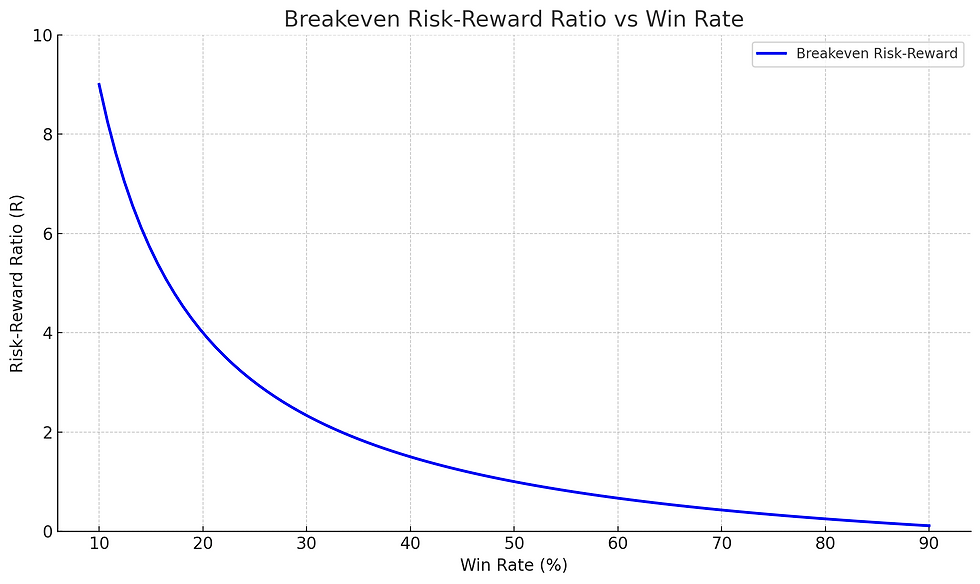

As you begin to gather your trading stats you can take the average of all your winning trades and divide them by the average of all losing trades to determine your average risk-reward (RR) ratio. As you can see from the graph below, if you your RR is 2:1, you only need a win rate higher than 32% to be profitable.

Enter Position Sizing: The Hidden Driver

This is where most traders really screw it up. You can have the best edge in the world, but if your position size is inconsistent—or worse, emotional—your results will be too.

R-based position sizing is how you standardize your risk. It's the difference between being a professional and a gambler.

You’re not just taking a trade. You’re putting a fixed dollar amount at risk—every time.

Here’s how it works:

Let’s say your account is $25,000 and you decide to risk 1% per trade. That’s $250 per trade.

If your stop is $0.50/share, you buy 500 shares.

If your stop is $1.00/share, you buy 250 shares.

Different setups, different stops—but the same dollar risk. That keeps your edge intact.

When you do this:

You eliminate overconfidence (oversizing big “conviction” trades)

You survive drawdowns

You let math—not emotion—drive your system

And here’s the real kicker: your R-multiple only means something if your R is consistent. Otherwise, a 3R win on a tiny position doesn’t move the needle, and a –1R loss on an oversized trade wrecks your week. I won't go too deep into here but this is also the best way to grow an account via compounding. As your account grows, your R grows with it. You earn the right to size up. If you go through a drawdown then your risk amount automatically decreases until you start building back up again. I can't stress how important this is for longevity.

Build a Positive Expectancy System

Here’s the formula that matters:

Expectancy = (Win rate × Avg win R) – (Loss rate × Avg loss R)

Let’s break it down:

Win rate: 40%

Avg win: +2.5R

Loss rate: 60%

Avg loss: –1R

Expectancy = (0.4 × 2.5) – (0.6 × 1) = 1.0 – 0.6 = +0.4R per trade

Now multiply that across 100 trades:+0.4R × 100 = +40R

If you’re risking $250 per trade, that’s $10,000 in profit—on a 40% win rate.

What This Means for You

If you’re not tracking trades in terms of R and sizing accordingly, you’re flying blind.

✅ Journal your trades in R—not dollars

✅ Risk a fixed % per trade—position size based on your stop

✅ Don’t focus on being “right”—focus on protecting your downside and letting your edge play out

✅ Review your average win/loss R and your consistency over time

Final Thought

R-multiples tell you the quality of your trades. Position sizing determines whether that quality shows up in your account. Ignore either, and you’re just guessing.

But when you structure your trades around R—define risk, size accordingly, track results—you stop relying on luck. You’re trading like a business. You’re compounding your edge.

That’s how you shift from inconsistent to consistent.

Comments