Professional Trading and Common Misconceptions

- Hunter

- Jul 7, 2025

- 5 min read

Updated: Jul 13, 2025

Trading gets painted as the dream job. Total freedom, fast money, work from anywhere. It’s all over social media now, thanks to the rise of cheap brokers, online prop firms, and a wave of new traders who jumped in during the pandemic. The marketing machine behind it is relentless. Sports cars, lavish vacations, and huge profit screenshots. That's the bait.

The crazy part about trading is the barrier to entry is laughably low. I can’t think of another profession where a complete beginner with zero real experience can open an account, push a couple buttons, and actually make money that same day. Like Jack Schwager said, “Trading is probably the world’s only profession in which a rank amateur, the person who knows absolutely nothing, has a 50-50 chance of being right in the beginning.”

The freedom part can be real too. No boss breathing down your neck, no staff to manage, no customers to babysit. You can work alone, travel, spend time with your family, etc. But that kind of freedom doesn’t come from watching some TikTok kid driving a Ferrari, watching a few YouTube videos, reading a book, or paying thousands for a flashy trading course. The freedom comes from spending years working on your edge and inner game.

Anyone can draw trendlines and slap indicators on a chart. Technical or fundamental analysis isn’t rocket science. That’s not the piece that makes or breaks a trader. New traders always think there’s some hidden indicator or holy grail pattern that will unlock the riches they dream about. It doesn’t exist. Trading done as an actual business is a game of managing risk, uncertainty, and probabilities. It took me a long time to figure this out.

When I say professional trading, I’m not talking about hedge fund traders burning someone else’s capital. I mean the retail trader at home, risking their own bankroll, with no safety net when they mess up. That’s as far from the online highlight reel as it gets.

Why Most People Get Wiped Out

Most new traders lose because they have these preconceived notions about trading that sound good but actually kill accounts. Here are a few that trap almost everyone at first:

"Get rich quick" mentality

If you’re getting into trading to get rich quick, do yourself a favor and don’t start. The idea that you’ll pick this up in a few months, quit your job, and pull six figures from your laptop on a beach is a lie. Building a strategy that actually works takes years. It will test your patience, your ego, your discipline. Most people don’t have the staying power.

Predicting the market

A lot of people mix up the concept of investing vs. trading. New traders think the whole game is about predicting the market. They believe if they just research enough they’ll “figure it out” and beat everyone else. The truth is traders don’t predict, they manage risk. They know exactly where they’re wrong and they size their trades so that being wrong doesn’t wipe them out.

Profit driven vs. process driven

Amateurs only think in profits. If you made a thousand bucks on a trade but at some point you were sitting on a five-thousand-dollar unrealized loss you didn’t plan for, that’s not a good trade. That’s just luck and luck always runs out. Same thing with position sizing. Beginners have no idea how to size trades. They just pick a random amount or size based on how much they want to make, not how much they’re willing to lose. They think they need a big account to make real money, when the reality is you just need to know where your stop is and how much you’re risking every time you hit the button. If you don’t, you’re one bad trade away from blowing up your account.

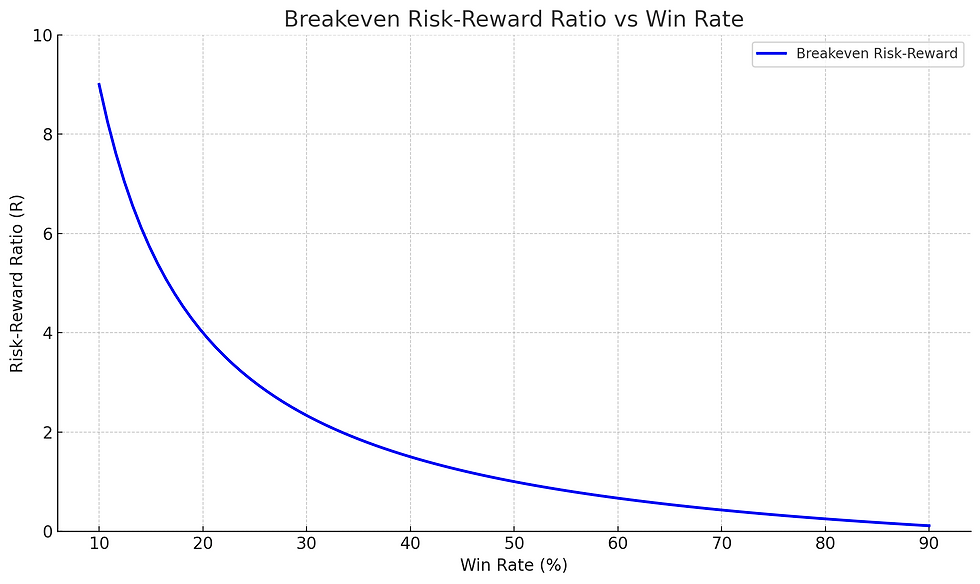

High win rate means I'm a good trader

The win rate myth traps people too. You can win 90% of the time and still lose money if your losses are bigger than your wins. One oversized trade can undo months of small gains. That’s boom and bust trading and it’s how your ego drains your account.

Herd mentality

If you think you need to watch CNBC or read the Wall Street Journal every morning to be a better trader, you’re already behind. The talking heads on TV are rarely right. They feed the herd. The herd loses. If you want to last, you have to learn to trust your own plan and block out the noise — which is a lot harder than it sounds when everyone around you is telling you you’re wrong.

What It Actually Takes

If you want to trade for real, not just play for show, you have to rewire how you think and how you act. There’s no shortcut. Here's what's non-negotiable: Relentless discipline

If there’s a holy grail in trading, it’s discipline. This is what keeps you alive long enough for your edge to play out. Anyone can draw up a plan — almost nobody sticks to it when money’s on the line and emotions are firing. There’s no boss telling you to clock in or out. Nobody’s going to stop you from breaking your own rules. If you don’t have the self-discipline to execute your plan exactly as you wrote it, then you’ll pay for it, simple as that.

Going against your instincts

You have to do the opposite of what feels natural. Most people hold losers too long and cut winners too soon. They want to be right more than they want to make money. Good traders flip this completely. They cut losses without thinking twice, they ride winners, they trust their plan when it hurts. If you don’t learn to override your instincts, they’ll sabotage you every time.

Independent thinking

You have to think for yourself, always. Human nature makes us want to stick with the herd. It feels safer to be wrong together than alone. But in trading, the herd is broke. You can’t copy other people’s ideas forever. You have to build your own, test them, own your wins and your losses, and stand on your own two feet. If you want someone to hold your hand, this game will eat you alive.

If you’ve read this far and you’re still serious, just know this: the freedom is real if your willing to earn it the hard way. And the cost is high. You pay with time, mistakes, humility, and discipline. You pay with sitting at your screen day after day when nobody’s watching. The upside is when you finally get there, nobody can take it from you.

Comments